An environmental consultant who holds interests in a property that made more than $40m selling conservation offsets to governments is part of a consortium that has made tens of millions of dollars more, Guardian Australia can reveal.

Steven House is a former director of Eco Logical Australia, a firm that advised governments on major projects in western Sydney.

He is also a director of Meridolum No 1 – a company that Guardian Australia revealed had made more than $40m selling offsets for infrastructure projects that Eco Logical, which employed two of Meridolum’s directors, provided offset advice on.

The directors denied any suggestion of wrongdoing or conflict of interest and said they made the appropriate declarations.

Now Guardian Australia can reveal that one of those directors – House – holds interests in two other properties that sold a further $66.8m in offsets for developments in western Sydney from 2017 to 2019.

The offsets on the properties – known as Hampden Vale and Hardwicke – were predominantly bought by the state and federal governments to compensate for developments including the second Sydney airport and new suburbs in western Sydney.

The windfall gains across all of the properties add up to more than $100m and account for 27% of all offsets sold since such schemes began in New South Wales.

Anthony Whealy, the director of the Centre for Public Integrity and a former NSW supreme court judge, said: “The sheer magnitude of the profits realised by private individuals and companies from a scheme essentially designed to protect and restore the environment raises serious concerns.”

The transactions warranted “a thorough investigation by the NSW auditor general”, he said.

Offsets are used to compensate for the environmental destruction caused by major development by protecting and restoring endangered habitat elsewhere.

In NSW, developers can do this by purchasing offset credits from properties that landholders have committed to conserving permanently under an agreement with the state government.

“Surely, the purpose of this scheme was not to make untold millions for private investors,” Whealy said.

“This is especially so when some of those who have profited were involved in the very consultancy process which advised government on western Sydney development.”

The former director

Steven House is an environmental scientist who now runs a brewery on the NSW south coast. From 2001 until early 2017, he was a director of Eco Logical Australia, a consultancy firm that has provided environmental advice to the NSW government for development across western Sydney since the 2000s.

Eco Logical has been involved in the state’s offsetting scheme since its inception and for years was the main private provider of biodiversity impact assessments of developments, training in the state’s offset scheme and conservation value assessments for private landowners.

In 2007, the state government contracted the firm to develop the original conservation plan for what is known as the western Sydney growth centres. That plan – publicly available – set out how much land the government would need to conserve to compensate for the bulldozing of habitat for new suburbs and 181,000 new houses.

Eco Logical went on to produce maps of priority conservation lands for the growth centres that appear in a 2010 agreement between the state and federal governments.

Over several years, until as recently as 2018, it also provided on-ground biodiversity assessments and environmental advice to the NSW planning and environment department as land was released for the growth centres, with House personally involved in reviewing some of those documents for Eco Logical Australia.

As Guardian Australia has reported, in 2015 and 2016 Eco Logical Australia provided advice to the NSW Roads and Maritime Services (RMS) on the environmental offsetting requirements for the Western Sydney Infrastructure Plan, a joint NSW and federal government roads program to support the new Sydney airport and surrounds.

The advice, which was not prepared by House himself, contains detailed information about the number and types of credits that the RMS would likely need to purchase as offsets and a list of potential properties from which those credits could be purchased. House has told Guardian Australia that he did not review the advice to RMS and that he has not seen the report.

In 2017, one of House’s colleagues at Eco Logical Australia was contracted by the RMS to procure the offsets for those roads.

The properties

During the period in which Eco Logical Australia was providing this advice to government, House acquired interests in land that went on to become offsets for these same projects.

He has denied any suggestion of wrongdoing or conflict of interest and told Guardian Australia he had never accessed confidential information in relation to the RMS, the airport or the growth centres.

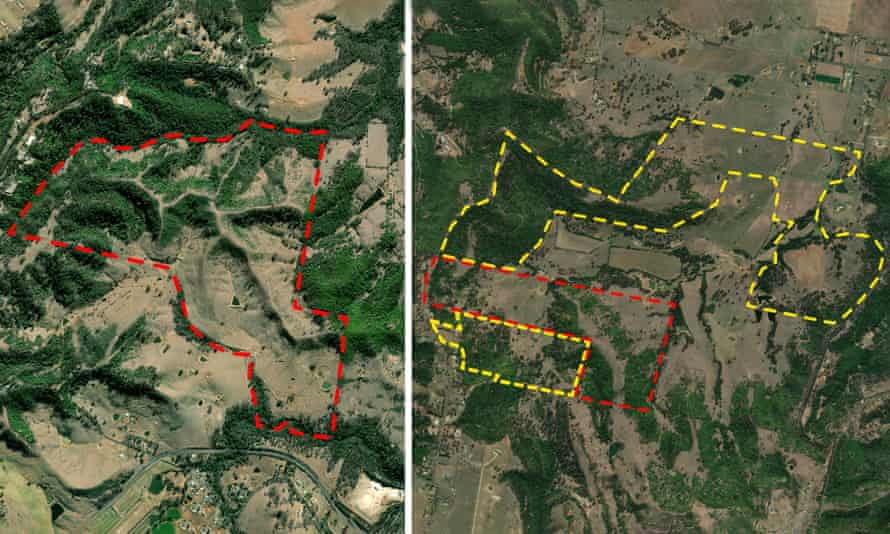

Hardwicke is a property in Orangeville in the Macarthur region of NSW that was bought for $2.8m in December 2013 and banked for conservation in two stages in March 2017 and November 2018.

The registered owners are four companies: South West Land Holdings, D Vitocco Constructions, Palolem Pty Ltd and Petroica Pty Ltd.

The Sydney property developers David Hazlett and Arnold Vitocco are, respectively, directors of South West Land Holdings and D Vitocco Constructions.

The sole director of Petroica Pty Ltd is House’s wife, Belinda. House told Guardian Australia Petroica was the corporate trustee for his family trust. It is unclear who the beneficiaries of that trust are.

Land records also name House as the owner of a property in Sydney’s Razorback bought in October 2015 for $2.7m and banked for conservation in March 2018.

That property, known as Hampden Vale, sits between the two parcels of land owned by Meridolum No 1, of which House is also a director.

Over a two-and-a-half year period, Meridolum, Hampden Vale and Hardwicke – all of which House holds an interest in – sold $118m in offset credits, according to the state’s biobanking register.

Based on data up to March provided by the NSW environment department, this is more than a quarter of all offset credits sold in NSW under the scheme since its inception, and 42% of credits sold to offset the destruction of a type of critically endangered woodland known as Cumberland Plain.

House told Guardian Australia he had never accessed confidential information in relation to the RMS, the airport or the growth centres and that he had made the appropriate declarations to government for the Hampden Vale and Hardwicke biobanks, as well as those owned by Meridolum No. 1.

Hazlett died earlier this year but a lawyer, acting on behalf of Hazlett’s company and Vitocco said “the directors and shareholders of the Hazlett and Vitocco interests had no access to any confidential information associated with the Western Sydney Infrastructure Plan”.

‘Urgent’ review needed

The transactions involving Hardwicke and Hampden Vale are “deeply concerning and undermine public confidence in the whole offsetting system”, according to Chris Gambian, the chief executive of the Nature Conservation Council of NSW.

The council has called for the Berejiklian government to refer the matters raised in Guardian Australia’s original investigation to the Independent Commission Against Corruption. The NSW Greens MP Cate Faehrmann has also written to Icac and to the state’s auditor general.

“The problem with commodifying natural assets like water and biodiversity is they inevitably become prey to speculative investors rather than being managed and protected in the public interest,” Gambian said.

“We believe the whole system of offsetting now must be the subject of an urgent review to ensure it does what the public expects – protects threatened wildlife and bushland in a rigorous and transparent way.”

James Trezise, a policy analyst at the Australian Conservation Foundation, said biodiversity markets were relatively new, under-regulated and had so far escaped the oversight of corporate regulators such as the Australian Competition and Consumer Commission.

“There is a clear need for a corporate regulator to step in here and give the public confidence that everything is above board,” Trezise said.

“We’re stepping away from this being solely an environmental issue to it being a corporate governance and accountability issue.”

Where the money went

About $100m of the relevant offsets were purchased by the state and federal governments for major projects, including $37.5m by the federal government for the new Sydney airport, $50.6m by the NSW RMS for projects associated with the Western Sydney Infrastructure Plan and $12.5m by the state government for the growth centres.

The 2016 environmental impact statement for the airport, prepared by the consulting firm GHD, names Hardwicke and Hampden Vale as potential biobanks from which the federal government might purchase offset credits.

But neither had been a registered biobank at this time – in fact, GHD wrote that it was alerted to Hardwicke through personal communication with another staff member at Eco Logical Australia.

The federal infrastructure department purchased more credits from Hardwicke and Hampden Vale than any of the other six bids in its tender for offsets for the airport, paying almost $20m for offsets at Hardwicke and $12.7m for credits at Hampden Vale.

Offsets for the growth centres are paid for using a combination of developer contributions and taxpayer funds.

The NSW environment department was unable to explain the process it used before spending millions on five separate purchases of credits from the Hardwicke and Hampden Vale properties in 2017 and 2018 for this program, or for a sixth purchase that was negotiated by the department and finalised by the Biodiversity Conservation Trust (BCT) in 2018.

The advice Eco Logical Australia produced for the NSW RMS on the Western Sydney Infrastructure Plan in 2016 names both Hardwicke and Hampden Vale on a list of potential properties from which the RMS might purchase credits to offset projects including the proposed M12, which will connect to the airport.

After purchasing $38m in credits from Meridolum for that program, the agency purchased $11.3m in credits in 2019 from Hardwicke and $1.3m from Hampden Vale.

House ‘always’ acted ethically

Transport for NSW and the NSW environment department have launched investigations into the transactions and have said it would be inappropriate to answer questions while they are under way.

A spokesperson for the BCT said the trust would support and provide information to the review where appropriate.

House told Guardian Australia he had “always acted in an open, ethical and transparent manner and have achieved best practice conservation and restoration ecology outcomes”.

“A cursory search will show that there has been a wealth of publicly available information on biobanking and infrastructure development in western Sydney for an extended period of time,” he said.

He said this included annual reports the NSW environment department produced on the offsetting program for the growth centres, which contain forecasts of the incoming funds for conservation on an annual basis.

Both the infrastructure department and the RMS ran tender processes before purchasing offsets, with the RMS also placing a “credits wanted” request on the state’s biobanking register. House said he informed governments of his role at Eco Logical Australia.

He said he never accessed the reports his colleagues produced for the NSW RMS and, together with the other directors of Meridolum, noted the 2015 draft environmental impact statement for the western Sydney airport and the final EIS published in 2016, which were both public, included calculations of the expected demand for offset credits for the airport project.

He said he could not remember if he was involved in Eco Logical Australia’s work on the 2007 conservation plan for the growth centres but said he had no involvement in producing the conservation maps that formed part of the 2010 agreement between the state and federal governments.

House added that due to conflicts arising as a result of his interests in three biobank sites, he was excluded from negotiations of offset sales from the Meridolum and Hardwicke properties.

Speaking on behalf of the Vitocco and Hazlett interests in Hardwicke, a lawyer said the property was purchased to generate biodiversity offset credits that would enable the developers’ Emerald Hills Estate at Leppington to proceed.

A spokesperson for the federal infrastructure department said the department “conducts all tenders … in accordance with commonwealth procurement rules”.

As part of the offset procurement process in 2019, “vendors were required to declare conflicts of interest and that they had not otherwise engaged in any collusion, anti-competitive conduct or any other similar conduct in relation to the preparation of the tender”.

The owners of Meridolum, Hardwicke and Hampden Vale “made these declarations, and advised the department of the detail of any conflicts of interest”, the spokesperson said.